The Only Guide for Offshore Wealth Management

Wiki Article

Our Offshore Wealth Management Diaries

Table of ContentsWhat Does Offshore Wealth Management Mean?Some Ideas on Offshore Wealth Management You Need To KnowWhat Does Offshore Wealth Management Do?Excitement About Offshore Wealth ManagementAll about Offshore Wealth Management

If you are aiming to overseas financial investments to assist secure your assetsor are concerned with estate planningit would certainly be prudent to discover a lawyer (or a team of attorneys) focusing on possession protection, wills, or company succession. You need to look at the investments themselves as well as their legal and tax ramifications - offshore wealth management.In most situations, the advantages of overseas investing are exceeded by the significant costs of specialist fees, payments, and also travel expenditures.

Jersey is an overseas place with deep-rooted ties to our footprint markets. With large industry understanding in wide range administration and also monetary structuring, Jacket is considered among one of the most established and also well-regulated overseas financial centres in the globe.

The Of Offshore Wealth Management

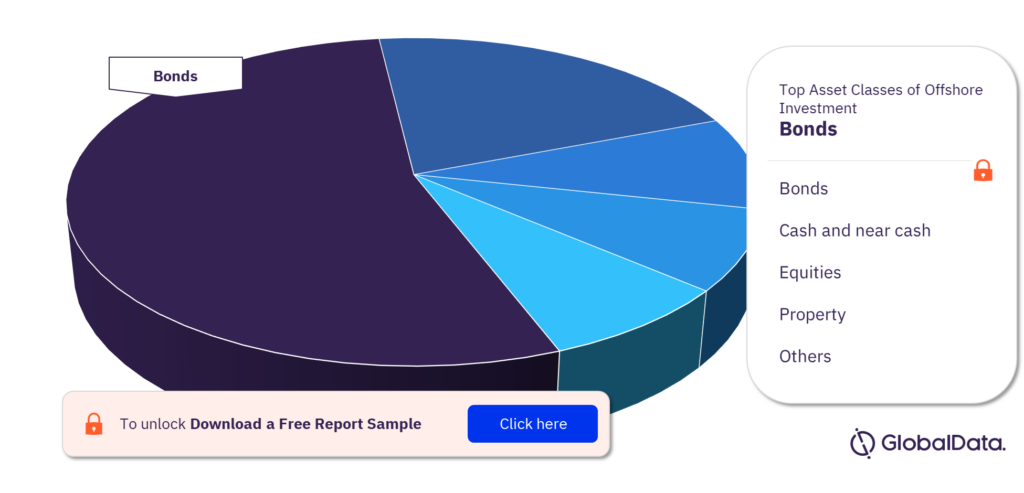

List of Numbers, Figure 1: Offshore possessions rose early in the pandemic as financiers looked for safe havens early on and after that sought investment chances, Number 2: The tidal wave of non-resident riches into Europe is receding, Figure 3: The central duties of New york city and also London continue to be even after wide range drains from elsewhere in the areas, Number 4: Asia-Pacific is as soon as again back to driving development in the offshore market, Figure 5: Unfavorable macroeconomic 'press' variables are driving the rise in HNW overseas financial investment, Figure 6: Australian investors that are keen to directly possess a trendy tech supply are being targeting by moomoo, Figure 7: Anonymity as well as tax were mostly lacking as vehicle drivers for offshoring during the pandemic, Figure 8: Financial institutions substantially raised their hiring for policy as well as conformity in the very early months of 2022Figure 9: Regulation-related work working with from Dec 14, 2021 to March 14, 2022 contrasted to previous quarter, Number 10: The North American market is well provisioned with overseas solutions, Number 11: Currency danger has actually expanded over the last ten years and also is heightened in times of crisis, Number 12: Most private wealth companies in the US as well as Canada can attach clients to overseas partners, Number 13: Citibank's offshore financial investment alternatives cover several possession classes, Figure 14: ESG is equally as crucial as high returns in markets that Criterion Chartered has visibility in, Number 15: Requirement Chartered's global solution accommodates both liquid and illiquid overseas financial investments, Number 16: HSBC Premier India solutions concentrate on global benefits and NRIs (offshore wealth management).There are numerous, as well as the complying with are just a few instances: -: in numerous countries, bank deposits do not have the same protection as you might have been made use of to in your home. Cyprus, Argentina as well as Greece have all provided instances of banking crises. By making use of an offshore financial institution, based in a very controlled, transparent territory with legal securities for financiers, you can feel protected in the knowledge that your cash this website is risk-free.

A partnership manager will constantly give an individual point of call who should put in the time to recognize you and your needs.: as an expat, being able to maintain your savings account in one location, regardless of how many times you relocate countries, is a major advantage. You also know, no matter where you remain in the globe, you will have accessibility to your cash.

The smart Trick of Offshore Wealth Management That Nobody is Talking About

These array from keeping your money outside the tax web of your house country, to protecting it from taxes in the nation you're currently living in. It can likewise serve when it concerns estate planning as, depending on your citizenship and tax status, possessions that being in your overseas savings account might not be subject to inheritance tax obligation.

Investing via an offshore bank is uncomplicated and also there is typically guidance or devices available to help you create an investment portfolio ideal to your threat profile and the results you wish to achieve. Attaching an overseas checking account is usually a lot more adaptable and also clear than the choices that are traditionally used.

You can take benefit of these benefits by opening an overseas financial institution account., like AES International, can open an offshore exclusive bank account for you within 48 hours, offered that all the requirements are met.

Top Guidelines Of Offshore Wealth Management

Prior to you invest, ensure you feel comfy with the level of risk you take. Investments goal to grow your cash, but they may lose it also.This is being driven by a solid willingness to move in the direction of class, based upon an acceptance of international know-how in terms of products, services as well as processes. In India, meanwhile, the huge quantity of new riches being created is productive ground for the ideal offering. In line with these and other local fads, the meaning as well as range of personal banking is transforming This Site in much of these neighborhood markets in addition to it the requirement to have access to a wider selection of products as well as solutions - offshore wealth management.

What Does Offshore Wealth Management Do?

With greater in-house expertise, clients are likely to really feel much more supported. Consequently, the goal is to grad a larger share of their pocketbook. However, international players require to make note of a few of the challenges their counterparts have actually faced in specific markets, as an example India. Most of global organizations which have actually established a company in India have actually tried to adhere to the very same model and also style as in their home nation.

Report this wiki page